Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a consulting engineer who makes $101,000 per year and spends some of her money this week on a barbell.

Occupation: Consulting Engineer

Industry: Mining

Age: 27

Location: Tucson, AZ

Salary: $101,000

Net Worth: ~$124,250 ($157,500 for my half of a house that my partner and I share, $55,000 in an investment account, $30,000 in a personal savings account as an emergency fund, $20,000 in a 401(k), $6,000 in an HSA account, plus $20,000 in savings in my home country where I went to school, minus debt. My partner, F., also has about $100,000 in savings and investments but we do not share finances beyond the home we own.)

Debt: $24,000 on my car, $280,500 remaining on the mortgage (split between me and my partner, so $140,250 my half)

Paycheck Amount (biweekly): $2,600

Pronouns: She/her

Monthly Expenses

Mortgage: $2,187 (split in half between me and my partner)

Car Payment: $593

Utilities: $275 (split between me and my partner)

Internet: $50

Spotify Family: $15 (split between me, my partner, and our old roommate)

Spotify Student: $5 (for my brother, I use the Hulu account that is bundled into that)

Netflix/HBO: $0 (I will mooch off my parents until I die)

Amazon Prime: $0 (I use my mom’s subscription)

HOA: $47

Trash: $21

Cell Phone: $25

Car Insurance: $275 car insurance (split between me, partner, and brother, T., since he lives with us and drives our cars to school)

Local Abortion Fund Donation: $50

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Absolutely. My parents are typical immigrants who were only able to get the opportunities they had through education. It was their way out and, growing up, it was the only option for both me and my brother. I went to a four-year university and got a bachelor’s in engineering. My family and I didn’t move to the US until I was about 11. Before that, in my home country, the government had a program that allowed parents to open accounts for their child’s education and would match up to 20% of their contributions. Coupled with the fact that I went to school back in my home country where tuition was around $6,000 for the entire year and I took two years off in school to work year-long internships, I graduated with no debt and in fact had leftover money from these internships to get a head start in my finances when I left school.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents never told me the exact details of our financial situation. They did remind me constantly of the fact that they grew up in severe poverty in a developing country and that I needed to be careful with my money (as in, never ever take on debt except for a mortgage) if I wanted to continue living the lifestyle they provided me with growing up. My mom and I have a lot of discussions about what is worth splurging on and what is worth saving on, but as far as investing and growing my wealth, that has been something I’ve had to figure out on my own.

What was your first job and why did you get it?

In high school, all I wanted was an after-school job but I couldn’t get one because of my visa status. As soon as I got my green card in my first year of college, I worked retail during the summers.

Did you worry about money growing up?

Yes, in the sense that my parents constantly told me about what it was like growing up poor, but our family was always financially stable. They were low-income until I was about three, but you don’t notice wealth at that age. After that, my parents worked in tech and always ensured my brother and I were provided for. We had a nice house, had one vacation a year, and all my school supplies and clothes were paid for.

Do you worry about money now?

Not at all. My boyfriend and I both live well below our means and are quite happy that way. Many of our spending habits haven’t changed since college and we both have a healthy cushion in case of emergencies like medical bills or if either of us were to lose our jobs. These days, the only thing I worry about with my finances is if I’m investing/saving properly for the future and if I’m donating enough. Knowing that so many Americans are one missed paycheck away from homelessness, I feel both incredibly privileged and also incredibly uncomfortable about my wealth.

At what age did you become financially responsible for yourself and do you have a financial safety net?

21, after I got my first co-op job as a student. This was basically a year off of school to work an internship in my field. It paid $45,000 a year and I was able to save enough for the next year of school. I did this two separate times during my degree and had about $25,000 saved when I graduated. Right now, I know if I were to lose my job I could probably spend over a year unemployed if I had to.

Do you or have you ever received passive or inherited income? If yes, please explain.

No, but F. inherited about $30,000 from his grandmother when she passed away about 12 years ago. He saves most of it in an investment account and tries not to touch it.

Day One

7:45 a.m. — The cats wake me up. I chug a bottle of water before immediately sitting down at my desk for a one-on-one with my manager.

9 a.m. — My one-on-one ends early so I get up and make myself an oat milk latte along with some scrambled eggs and leftover rice from last night. I bought a Breville espresso machine earlier this year with my credit card points and my daily latte is now my primary joy in life (although there will never be anything good enough to stop me from getting $7 lattes from a local café on the weekends).

11:30 a.m. — I eat a sandwich and some shrimp chips for lunch. Some of the bosses from overseas are visiting the office this week so I figure I should make some kind of effort to show up and meet them in person for the “collaborative culture.” I pack all my stuff into my bag and head out. Can you tell I resent having remote work taken away?

3 p.m. — My brother, T., buys some lunch and school supplies on campus and puts them on my credit card. He lives with me because I balked at the cost of on-campus living at his university and told him he could stay with me to save some money since our parents are paying for out-of-state tuition. I made him an authorized user on my card last year until he could build enough credit history to apply for one this year. I have him go over the credit card statement every month, calculate his total, and then our parents Venmo me his balance for that month. This way he can start being aware of his spending habits before he has his own credit card. He mostly buys food and school supplies and sometimes pays for parking on campus when he has to stay late. He never spends frivolously and if there is something material that he wants he normally calls me to let me know, though I’ve told him he doesn’t have to do this. $48

5:30 p.m. — I work out at the office gym before leaving for a team dinner in town.

6:45 p.m. — I’m the last to arrive at the dinner (whoops). Luckily my coworkers have already ordered me fries. My boyfriend, F., works at the same company, so he is already there as well. I order a burger bowl and when the check arrives our VP picks up the bill. I know my brother will be hungry when we get home and is also busy with schoolwork so I order a burger and fries to go for him. F. apparently also had the same thought and immediately cancels his order. $21

9 p.m. — F. and I head home in our separate cars, but he calls me while we’re at a traffic light to tell me he’s getting DQ and that I should go with him for quality assurance purposes, obviously. We order two kid-sized chocolate-dipped vanilla cones. While we eat them in the parking lot, we see the teeny-tiniest frog under my car and spend the rest of the time trying to usher it towards a drain for its own safety. F. put the ice cream on his card but we’ll tally up and split the total at the end of the month. $3.29

9:45 p.m. — We get home and F. plays some video games with his friends online while I shower and do my skin-care routine (oil cleanse, CeraVe cleanser, The Ordinary Niacinamide and Zinc, then Hada Labo Gokujyun Moisturizer). I splay out on the couch with a book for the rest of the night. I just started Transcendent Kingdom by Yaa Gyasi and am loving it so far. I go to sleep after a few chapters.

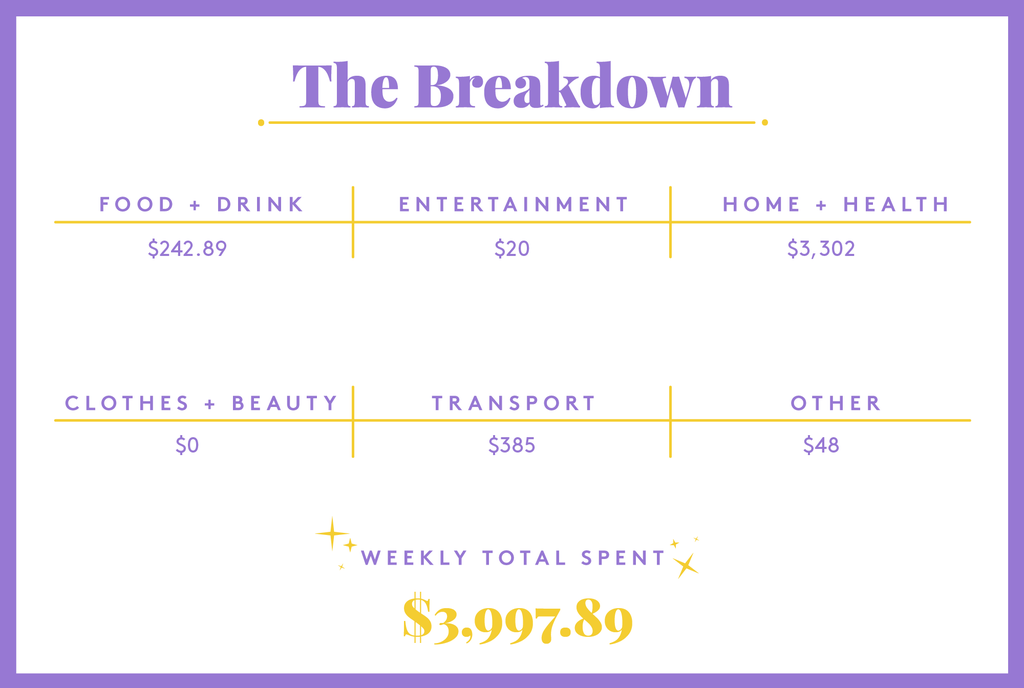

Daily Total: $72.29

Day Two

8:30 a.m. — I wake up feeling weirdly groggy so I drink water in bed while scrolling my phone before I get up to brush my teeth and start my day.

9:30 a.m. — At my desk, but the task I have for today is such a drag and I’m frustrated because it’s also technically not one of my job responsibilities. I go to the kitchen to make a latte and some eggs and toast for breakfast as a way to procrastinate on it.

12 p.m. — F. and I want to visit his parents in Washington sometime next month so he books our flights using his card, but we’ll split it. With my brother living with us, the way we’ve been managing expenses is to put everything shared between the two of us on F.’s credit card, while my brother, T., uses my credit card and keeps all his expenses to that one card or uses his debit card. Expenses for the three of us, like groceries and utilities, are put on another card that is in my name. This way we don’t have to spend too much time calculating everyone’s individual expenses. I don’t want to be counting pennies when it comes to family so it’s easier to just roughly look at the credit card statements and divide by two or by three. Anything F. and I buy for just ourselves gets put on our respective credit cards and left out of the monthly split. $308

2:15 p.m. — I make cold noodles with sesame sauce for lunch. I double the portions so that F. can have some too and we also finish leftover edamame and shishito peppers from dinner earlier this week. Afterward, we split a peach as well.

3 p.m. — I get a message from the manager of my project and my task shrinks from 12 hours to two instantly. I breathe a sigh of relief. F. lets me know that he bought a replacement for our barbell since ours has a diameter that’s too big and causing issues with both of our grip strengths ($230 total, $115 my half). $115

6 p.m. — I’m off the clock! I make a chickpea stew in the Instant Pot. After, I disassociate for a bit by scrolling through Instagram. At some point in the day, T. arrived home. He makes himself a grilled cheese and offers both me and F. a few bites of it.

7 p.m. — I spend 30 minutes on the rowing machine that F. and I bought secondhand last year. If you have the funds to do it, I HIGHLY recommend investing in secondhand gym equipment. Between the rowing machine and free weights, F. and I spent about $1,200 between the two of us and it’s been amazing to have at home.

8:15 p.m. — I shower after my workout before sitting down to eat with T. and F. We watch Breaking Bad while we eat.

10:30 p.m. — F. showers and I read in bed. I try some heatless curls using leggings (??) that I saw on TikTok. We’ll see how this goes in the morning. I stay up too late reading and don’t go to bed until midnight.

Daily Total: $423

Day Three

8 a.m. — To no one’s surprise, the TikTok curls did not work the way I thought they would. The back looks nice, but the front is nothing special and my head got really hot from having the leggings on it while I slept. I have really long hair, though, so I’m able to get away with just running a comb through everything quickly and it looks more or less presentable. I get up, brush my teeth, and drink water while reading my emails. I don’t always feel like eating breakfast so just have my usual oat milk latte today.

9:30 a.m. — I get an invoice from the landscaping company we’re working with for the first payment of the job they’re doing for us. When we bought the house last year, the backyard was just a dirt lot. Normally this would be something I would do myself since I love to garden, but the landscaping company I found specializes in passive rainwater harvesting and native pollinators which is important to me because water consumption and declining bee populations in Arizona are both huge issues. I know that at the residential level this is nothing in comparison to other large users of water, but I figure I should put my money where my mouth is (literally). I pay the bill and Venmo request F. for half since it comes straight out of my checking. The remaining three payments will total $17,000 in a few months after they break ground ($2,024, but I pay for half). $1,012

10 a.m. — It is Friday and I am oooooooover work already. I get up and make another latte while I read over some documentation I need to review. I don’t have anything else that needs to be done today and no meetings either so I bring my laptop to the couch and half read, half play with one of the cats. I took a half day today so that F. and I could pick up the new flooring that we’re installing together. 100 percent mentally checked out.

12:30 p.m. — My PTO kicks in and I log off. I wasn’t feeling breakfast this morning, but I’m a little hungry now so I inhale some leftover rice and a scrambled egg with some kimchi and sesame oil. We’re replacing all the carpet in our house with vinyl plank. I placed the order a month ago through a local store in town and they called last week saying it had arrived. Since we’re doing the installation ourselves, we have to pick it up. F. and I head out to pick up the U-Haul and then head over to the flooring store. We don’t have to pay for the truck until we return it.

1 p.m. — On our way into town, we decide to grab lunch first before picking up the flooring. The only place that’s healthy-ish along the way is Whole Foods, so we decide to grab sandwiches from there. Conveniently, it’s next to my favorite secondhand bookstore so I peruse the shelves while F. picks up the sandwiches. I find Goodbye, Vitamin by Rachel Khong and Dust by Hugh Howey and F. orders us two veggie sandwiches. The books are $20 and the sandwiches are $8 each. $28

2:30 p.m. — We arrive at the flooring store and while they load our pallet onto the truck, I fill out a check for the remaining balance. I had already put down a little under half as a deposit when we first ordered so the remaining total is $4,350 ($2,175 for my half). They weren’t the cheapest option, but the store is locally owned and run by immigrants so I’m happy to give them my business over Home Depot or another big-box store. Plus, the flooring itself is manufactured by a company with sustainable manufacturing processes and is completely recyclable. When F. and I graduated, we both agreed we wanted to spend money more meaningfully. We try not to spend frivolously, but when we do, we try to make our money go towards businesses and products that we think are worth it even if it costs more as long as we can afford them. The less of my money I can give to billionaires, the better (I know we just bought sandwiches at Whole Foods, but I’m doing my best where I can). $2,175

3 p.m. — We stop at Home Depot to pick up a vinyl cutter F. ordered earlier this week. He paid for it when we ordered it online last week so it costs us nothing at the store. We drive home slowly since the truck is carrying a pretty heavy load.

4 p.m. — We pull into our driveway and start unloading the boxes of planks. It’s only one pallet but together it all weighs over 6,000 pounds. We use the dolly in the truck to unload the boxes two at a time and it is slow going. It also doesn’t help that the temperature is in the triple digits. We eventually, painfully, get everything unloaded. F. and I return the U-Haul and stop for mini dipped cones from DQ again on the way home. Ever since we realized there was one literally a block away from us, all self-control has gone out the window. The U-Haul totals to $90 ($45 for me) while the DQ is $3.29 (I pay). When we get home we veg out for a little by watching YouTube videos to let the heat exhaustion settle down. $48.29

8 p.m. — I put some rice into the rice cooker and shower while it cooks. When I come out, I make a Chinese tomato and egg stirfry along with some steamed cod in scallion sauce. T. is out with his friends tonight so F. and I watch a few episodes of Breaking Bad without him while we eat. T. comes home shortly after and we all watch some anime before going to bed.

Daily Total: $3,263.29

Day Four

11 a.m. — We wake up late. F. gets up before me and makes us scrambled eggs and toast. It’s the weekend so I make myself an oat milk cinnamon mocha instead of my usual latte. Wild, I know. F. and I have already been watching flooring installation videos, but we watch a few more just to make sure we’re prepared. Then we get started taking out the baseboards. T. comes out when he hears us cursing in frustration and takes a break from his homework to help us.

3 p.m. — We’ve torn out most of the baseboards in the main living areas and have now worked up an appetite. I send T. out to pick up sandwiches from Sprouts and he buys one for each of us plus an extra one for himself because he is every teenage stereotype of being a bottomless pit when it comes to food. After the sandwiches, we start measuring and laying planks down. A couple of hours in, my back and knees start to hurt a little, but I enjoy working with my hands and did a lot of manual labor as an intern so I find the pain kind of… enjoyable? Weird, I know, but I don’t know how to explain it. $20

9 p.m. — We decide it’s time to eat. There’s no way in hell I’m cooking tonight, so we order pizza from a local place. Because I have a teenage boy to feed, we order two large pepperonis and a salad. F. drives out to pick up our order and I stay home and redo a row that’s ever so slightly askew. We eat our pizza and watch more Breaking Bad. I let the boys clean up while I install another two rows of planks by myself. My legs and back are screaming at me but I’m hyper-fixated now and am pretty convinced I will explode if I don’t do just one more row. I get carried away and don’t shower/go to bed until after midnight. $64

Daily Total: $84

Day Five

10 a.m. — Wake up late again. I think I will probably be struck by lightning before I become a morning person. F. makes smoothie bowls for breakfast with bananas, oat milk, and frozen berries topped with a mix of seeds and nuts from our pantry. Oat milk cinnamon mocha again as well. I manage to pour a perfect milk foam heart and the two of us ogle at it in amazement.

11 a.m. — F. and I come up with a list of meals we want to have for the next few days and make a grocery list. He runs out to pick them up while I put down another two rows of flooring planks. He buys salmon, eggs, eggplant, zucchini, tomatoes, oat milk, dairy milk, chuck beef, ground beef, and cucumbers ($160, $80 for my half). He also fills up my car on gas ($32). When he comes back, we stop and reheat leftover pizza for lunch and take a break by watching another episode of Breaking Bad before starting to install flooring again. I pop a Pepto Bismol tablet, an Alka-Seltzer, AND a Lactaid. Normally we only eat out about once a week and the extra fats and salt are really not sitting well with me at this point. $112

8 p.m. — We manage to install the entire common area before calling it a day. We clean up while drinking some water because we haven’t been hydrating enough. I was going to make beef noodle soup for dinner but my legs and back are starting to ache. The only thing that is open late near us is Chipotle. I pick up a chicken bowl for T. while F. gets a carne asada bowl and I get myself a birria bowl with brown rice, all the veggies and salsas, and sour cream on the side. I want to add guac but it costs nearly THREE dollars now and I just cannot abide it. $35

9:30 p.m. — Arrive home and eat while watching an episode of Breaking Bad. I shower immediately so that I can go to bed in time to be up for work tomorrow.

Daily Total: $147

Day Six

6:30 a.m. — I wake up and am already over it. I have to be at our testing facility today which is about a 45-minute drive out of town so I quickly make some toast and slather peanut butter and sliced bananas on top. No time for a latte today. I squeeze both of the cats and F., who is still in bed, before getting in my car. I listen to the podcast Authentic: The Story of Tablo on my way to work. Bad idea because I’m on the second to last episode and it makes me cry.

7:50 a.m. — Arrive at the site and start the field tests. I’m not actually the one who is supposed to run any of the tests — I’m just here to gather data when it’s done, but everything is recorded automatically from the machines into a database. I try not to be annoyed about the fact that it’s really unnecessary for me to be here in person. The one saving grace of today is that everyone here is chill and fun to talk to.

11 a.m. — Everyone breaks for lunch. I didn’t pack anything so I drive out to a nearby Subway and pick up a six-inch tuna sub stuffed with as many veggies as I can get. I head back to the site to finish up our testing. $8.31

3 p.m. — Done for the day! I say my goodbyes and thank yous to the staff at our testing facility and then sign out and head home.

4 p.m. — I arrive home and F. makes us both a smoothie with bananas, oat milk, peanut butter, and frozen berries. We watch Never Have I Ever while we have our smoothies. F. says he’s not into the show but then brings his laptop out to the couch while he finishes his work day. He gives up pretending eventually and starts yelling things at Devi. I roll my eyes while laughing because I know I have to rewatch the whole show with him now so that he can be caught up.

7 p.m. — At some point, I fall asleep on the couch. F. nudges me awake so I don’t throw my sleep schedule off completely. He makes a pot of rice before going to the garage to work out. A few weeks ago, I visited my parents and my mom sent me home with frozen marinated beef tendon she made. I add it on top of the rice and let them steam together. I make another scrambled egg and tomato stir fry as well as a smashed cucumber salad. T. gets home from school as I’m finishing up in the kitchen and we all eat together while watching another episode of Breaking Bad.

8:30 p.m. — I shower while the boys clean up the kitchen. When I come out T. asks me to help him meal prep some meatballs to bring for lunch for the rest of the week. I talk him through all the steps while he makes them. Having T. live with us has meant I’ve had to spend more time making food for him since he doesn’t have a dining hall to eat at. I think he feels bad about this, so he’s been trying to learn to cook more for himself in his spare time. I don’t mind cooking for him and would rather he focus on his studies but it can be time-consuming. Once he doesn’t need my help in the kitchen anymore I read a bit before going to bed.

Daily Total: $8.31

Day Seven

8:30 a.m. — I didn’t put on my Apple Watch last night so I wake up completely naturally and it feels amazing. I really am a nine-hours-of-sleep kind of person. I brush my teeth then change out of my nighttime pajamas and into my daytime pajamas. I make an oat milk latte then sit down to read through my inbox and also respond to messages from my boss about an analysis I’ve been working on.

1 p.m. — F. pops into my office to remind me to eat. He empties the dishwasher and cleans up the breakfast dishes in the sink while I make two portions of cold noodles in sesame sauce. I add a hardboiled egg, cold tofu, and julienned cucumbers to each bowl and sprinkle everything generously with furikake. We both squish each of the cats for a bit before returning to our desks.

4 p.m. — My manager gets back to me with feedback about an analysis I made that will be reviewed with our vice president this evening at 5:30. It stresses me out a little because I just finished the last round of edits and the meeting is in less than two hours. I open up a homemade kombucha to get me through the rest of the day.

7 p.m. — The meeting is (finally) over. I write down all the feedback and let it be tomorrow’s problem. For dinner, I make a beef noodle soup in our Instant Pot with beef chuck, onions, garlic, ginger, spicy bean paste, and a blend of Chinese five spice. While it cooks in the Instant Pot, I do a lower body workout in the garage. My goal is to be able to squat five reps of 200 pounds by the end of this year and I’m currently at 175 pounds so I’m feeling optimistic! After, I boil noodles and leafy greens for the soup. Eat, Breaking Bad, shower. Read more of my book and fall asleep around midnight.

Daily Total: $0

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Missouri On A $50,000 Salary

A Week In North Florida On A $370,000 Joint Income